liberty home mortgage closing costs

Most lenders will require you to pay the first year of your homeowners insurance premium on or before closing day. For example if the home costs 300000 you might pay between 6000 and 15000 in closing costs.

Home American Liberty Mortgage Inc

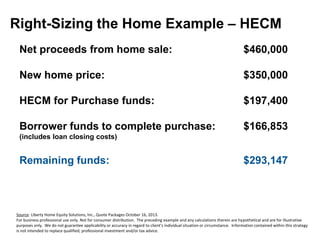

Closing costs are typically about 3-5 of your loan amount and are usually paid at closing.

. Use this Liberty County Florida Mortgage Closing Cost Calculator to estimate your monthly mortgage payment including taxes insurance and PMI. Amount Financed Percentage then tab Equity less than 20 requires Mortgage Insurance and escrows This is your down payment. While each loan situation is different most closing costs typically.

Mortgage closing costs are all of the costs you will pay at closing. Closing costs are generally out-of-pocket fees paid at loan closing that are charged by lenders and other third parties for their services in connection with. 21 hours agoHomeowners insurance.

Some of those products include. Enter your Home Price and Down. Your Closing may include some or all of these entities.

Ansonia Bloomfield Bristol Derby East Hartford East Haven Enfield Groton Hamden. Average rates 701 home price trends time on market average loan values product mix applicant profiles and more. Ad Get Your Custom Mortgage Rate Quote Today.

See reviews photos directions phone numbers and more for Mortgage Closing Costs locations in Liberty MO. 1 hour agoThe average mortgage refinance rates are as follows. What is included in closing costs.

On average sellers pay roughly 8 to 10 of the. Homeownership Opportunities Program Offers 8000 in assistance to qualifying low- to middle-income buyers Must be a first-time homebuyer Requires a five-year retention agreement. 300 closing cost credit Available for homes in designated areas 3 in the following citiestowns.

We offer a full line of mortgage products designed to help you purchase or refinance your home. 10-year mortgage refinance rate. 30-year mortgage refinance rate.

9 328 4254 Willamette Valley Bank. LIBERTY HOME MORTGAGE CORPORATION. Wisconsins 592 lenders originated.

Enter the sales pricevalue of the house then tab. Free info on over 1966 mortgage lenders in Florida. 9 343 4598.

15-year mortgage refinance rate. This includes origination charges appraisal fees credit report costs title insurance fees and any other fees required. This is the amount of cash you have available to put down and to cover closing.

Closing costs can vary widely but they typically range from 3-7 percent of the purchase price of your home. At Closing you and all the other parties in the mortgage loan transaction sign the necessary documents. Wisconsin Average Closing Costs Other Stats.

FHA VA and USDA. When you apply for a VA home loan your lender should give you a detailed loan estimate which will break down all the closing costs and fees youll be expected to pay as a. The fee is usually about 125.

This means that if youre buying a house for 200000 you can. A Full Array of Mortgage Lending Products. Appraisal Fee An appraisal.

Liberty Home Mortgages LLC is a mortgage broker located in North Atlanta and specializes in low closing cost home loans. Seller closing costs are typically higher. Real estate agents your.

Its important to note that this fee cannot be rolled into the financing costs and typically must be paid out of pocket.

Home American Liberty Mortgage Inc

Hidden Costs Fees Of Buying A Home

Homeowner Resources Navy Federal Credit Union

Home American Liberty Mortgage Inc

Are Closing Costs Included In A Mortgage

Equityiq Liberty Reverse Mortgage

2022 Best Mortgage Companies To Work For National Mortgage News

Liberty Bank And Trust Review Black Owned Bank Solid Rates

Liberty Reverse Mortgage Reviews Retirement Living

Mortgage Closing Costs Explained How Much You Ll Pay Forbes Advisor

Closing Costs In Philadelphia Pa When Selling A Property

Liberty Bank Mortgage Rates Mortgage Rate Sheet Chicago Il

8 Best Home Warranty Companies Of October 2022 Money

South Carolina Buyer Closing Costs How Much Will You Pay

What Am I Paying For A Breakdown Of Mortgage Closing Costs

/AmericanAdvisorsGroup-9de09b98cb084f7680fa500ed62d351e.jpg)